Economy - Budget Highlights (2020): Sector-wise Analysis

Growth Forecasts and fiscal projections to be achieved by Budget 2020

- Fiscal deficit of 3.5% of GDP has been set for current financial year.

- Nominal GDP growth rate has been targeted at 12%of GDP.

- Overall GDP growth rate has been forecasted for 2020-21 growth at 6%-6.5% by Economic survey.

- To sustain fast GDP growth rate and achieve 5 trillion economy target, India needs to invest 1.4 trillion dollars in infrastructure.

This budget is woven around three prominent themes:

- Aspirational India in which all sections of the society seek better standards of living, with access to health, education and better jobs.

- Economic development for all, indicated in the Prime Minister’s exhortation of “Sabka Saath , Sabka Vikas , Sabka Vishwas”. This would entail reforms across swathes of the economy. Simultaneously, it would mean yielding more space for the private sector. Together, they would ensure higher productivity and greater efficiency.

- Caring Society: Ours shall be a Caring Society that is both humane and compassionate. Antyodaya is an article of faith

Aspirational India:

1. Agriculture, Irrigation and Rural Development: Sixteen Point Agenda for doubling the farmer’s income by 2022

- Adoption of Model Laws such as: These laws have already been enforced to be adopted by state government:

- Model Agricultural Land Leasing Act, 2016

- Model Agricultural Produce and Livestock Marketing (Promotion and Facilitation) Act, 2017;, and

- Model Agricultural Produce and Livestock Contract Farming and Services (Promotion and Facilitation) Act, 2018.

- Water Security: It aims to address the water stress issue in hundred water stressed districts.

- Solar Pumps under KUSUM Scheme: It aims to 20 lakh farmers for setting up stand-alone solar pumps and further to help another 15 lakh farmers solarise their grid-connected pump sets under KUSUM Scheme.

- Sustainable use of fertilizers: The budget has sought to use all kinds of fertilizers including the traditional organic and other innovative fertilizers in a sustainable manner with a ‘balanced approach’.

- Development of forward-linkages:

- Proposal of geo-tagging of all warehouses which are present in the country.

- Proposal of setting up of warehouses in accordance with norms set by Warehouse Development and Regulatory Authority (WDRA) at block/taluk level with Viability Gap Funding by the central government.

- Village Storage scheme to be run by Self help Groups (SHGs) in order to store the agricultural produce and provide farmers a good holding capacity and reduce their logistics cost.

- National Cold Supply Chain and “Kisan Rail” to be setup to provide better storage and transportation facilities for perishable agricultural goods.

- Proposal of refrigerated coaches in Express and Freight trains to transport perishable agricultural products.

- Krishi Udaan Scheme: This will be launched by Ministry of Civil Aviation on international and national routes to transport agricultural products specially fish, meat and dairy products across globe.

- “One product one district” Scheme in horticulture sector to be supported by central government by providing incentives to those states which supports cluster-wise production of horticulture products.

- Promotion of ‘Integrated Farming System’ in rainfed areas to counter the vagaries of monsoon or unseasonal rain.

- This will include Multi-tier cropping, bee-keeping, solar pumps, solar energy production in non-cropping season. Zero-Budget Natural Farming will be promoted in this area to reduce the on-farm expenditure by farmers.

- Budget proposes to strengthen Negotiable Warehousing Receipts (e-NWR) which will be integrated with e-NAM.

- Agricultural Credit:

- The budget proposes to strengthen agricultural credit by expanding refinance by NABARD and has set target of Rs. 15 lakh crore for agricultural credit.

- It has further intended to cover all eligible beneficiaries of PM-KISAN under the KCC scheme.

- Livestock and Animal Husbandary: Budget proposes to eliminate Foot and Mouth disease and brucellosis in cattle and also peste des petits ruminants (PPR) in sheep and goat by 2025.

- It also proposes to increase coverage of artificial insemination from existing 30% to 70%, development of fodder farms to produce quality fodder and doubling milk processing facility by 2025.

- Blue Economy: It proposes to put in place a framework for development, management and conservation of marine fishery resources.

- It aims to raise the production of fish and promotion of growing of algae, sea-weed and cage Culture. It will further employ ‘Sagar Mitras’ to involve youths in marine processing industries and form 500 Fish Farmer Producer Organisations.

- It aims to further help SHGs under Deen Dayal Antyodaya Yojana for alleviation of poerty.

- Adoption of Model Laws such as: These laws have already been enforced to be adopted by state government:

2. Wellness, Water and Sanitation

- It proposes to setup more hospitals tier-2 and tier-3 cities under PPP model and will provide assistance in form of viability gap funding.

- They will be setup in first phase with priority in those ‘Aspirational District’, which do not have empanelled hospitals under ‘Ayushman Bharat’ scheme.

- It reiterates to eliminate TB from India by 2025 and setting up of Jan Ausadhi Kendras offering 2000 medicines and 300 surgicals to all districts by 2024.

3. Education and Skills

- Budget proposes to announce ‘The New Education Policy’ which proposes to start a programme whereby urban local bodies across the country would provide internship opportunities to fresh engineers for a period up to one year.

- ‘National Police University’ and ‘National Forensic Science University’ have been proposed. It has also proposed to provide degree level full-fledged online education programme.

- It is proposed to attach a medical college to an existing district hospital in PPP model with availability of Viability Gap Funding from the government

Economic Development

1. Industry, Commerce and Investment

- The budget proposed Investment Clearance Cell that will provide “end to end” facilitation and support, including pre-investment advisory, information related to land banks and facilitate clearances at Centre and State level.

- It also proposed to develop five new smart cities in collaboration with States in PPP mode and sites will be chosen on the basis of location (near economic corridors and industries to be developed) and other factors.

- National Technical Textiles Mission has been proposed to create export oriented industry of technical textile.

- NIRVIK (Niryat Rin Vikas Yojana) has been proposed by the budget to achieve higher export credit disbursement to small exporters. This includes higher insurance coverage, reduction in premium for small exporters and simplified procedure for claim settlements.

2. Infrastructure

- National Infrastructure Pipeline to be strengthened which has already been launched with 103 lakh crore investment having 6500 projects across sector.

- Budget proposed for a National Logistics Policy to strengthen logistic sector.

- The budget proposed to replace conventional energy meters by prepaid smart meters in the next 3 years.

- It proposed to expand the national gas grid from the present 16200 km to 27000 km.

- “Arth Ganga” Plans to energise economic activity along river banks will be realised. It also proposed to complete NW-2 (Dhubri to Sadiya) by 2022.

- It has proposed to build infrastructure to harness solar power along the Railway track. It also proposed to run 150 more trains and on PPP model.

3. New Economy: Assimilating new technologies and governance ideas

- Budget proposed a policy to enable private sector to build Data Centre parks throughout the country.

- Fibre to the Home (FTTH) connections through Bharatnet will link 100,000 gram panchayats this year.

- The budget Proposed National Mission on Quantum Technologies and Applications to be setup with a corpus of 8000 crore rupees.

- The budget proposed ‘Fibre to the Home (FTTH) connections’ through Bharatnet to link 100,000 gram panchayats this year.

- It proposed to create two new national level Science Schemes to create a comprehensive database of genetic landscape of India.

Caring Society

1. Women & Child, Social Welfare

- Budget proposed to do away with manual scavenging by introducing automated cleaning of sewer lines with new technologies.

- It has also allocated a significant amount to nutrition-related programmes, programmes related to women and child development and welfare of’ schedule caste and schedule caste.

2. Culture & Tourism

- The budget proposed to develop five archaeological sites as iconic sites with onsite Museums. They are: Rakhigarhi (Haryana), Hastinapur (Uttar Pradesh) Shivsagar (Assam), Dholavira (Gujarat) and Adichanallur (Tamil Nadu).

- A museum on Numismatics and Trade will be opened at Old Mint building Kolkata and ‘Tribal Museum’ in Ranchi will be supported by the government.

- It also proposed to setup a maritime museum at Lothal, the Harrapan age maritime site near Ahmedabad, by Ministry of Shipping.

3. Environment & Climate Change

- Budget proposed to achieve targets set up by Paris Climate Deal by cutting emission and closing down those thermal plants whose emission is higher than pre-set limit.

- It also proposed to help state government to cut air pollution in cities.

Governance

- India will host G-20 presidency in the year 2022 - the year of 75th anniversary of Independence of Indian Nation. Budget has allocated a sum of Rs. 100 crore to begin the preparations for the event.

- It has also proposed a special package for newly created union territories of Jammu and Kashmir and Ladakh.

Financial Sector

- It has proposed to increase Deposit Insurance Coverage for a depositor under Deposit Insurance and Credit Guarantee Corporation (DICGC) from one lakh to Rs. five lakh per depositor.

- It has proposed to strengthen the Cooperative Banks by amendments to the Banking Regulation Act.

- It has proposed to sell the balance holding of Government of India IDBI Bank to private, retail and institutional investors through the stock exchange.

- Credit Guarantee Trust for Medium and Small Entrepreneurs (CGTMSE) has been proposed by the budget to provide subordinate debt for entrepreneurs of MSMEs.

Taxation System

- PAN to be allotted online on the basis of Aadhaar details without any requirement of detailed application.

- There have a lot of modifications for simplification of paying GST.

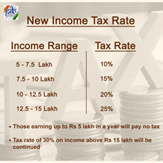

- Budget has proposed new taxation slabs for paying income tax

- Budget has proposed to abolish Dividend Distribution Tax (DDT) and instead proposed and adopt the classical system of dividend taxation under which the companies would not be required to pay DDT.

- The dividend shall be taxed only in the hands of the recipients at their applicable rate.

- It has proposed concessional corporate tax rate of 15% to new domestic companies engaged in the generation of electricity.

- It has proposed to grant 100% tax exemption to interest, dividend and capital gains income in respect of investment made in infrastructure and other notified sectors by the Sovereign Wealth Fund of foreign governments.

- Budget has proposed ‘Vivad Se Vishwas’ scheme under which will cover disputes related to Direct Taxes.

- Under this scheme, a taxpayer would be required to pay only the amount of the disputed taxes and will get complete waiver of interest and penalty provided he pays by 31st March, 2020.

- Option to be provided to cooperative societies to be taxed at 22% plus 10% surcharge and 4% cess, with no exemptions or deductions.

No comments:

Post a Comment